streamline your A&D due diligence.

Acquiring or divesting oil and gas assets requires loads of data to be gathered in a very short timeframe. Whether you are tasked with creating a sell-side data room or have the buy-side responsibility to perform due diligence on a short time fuse, you need all the help you can get. Our customers use oseberg as a “virtual data room” to quickly and easily collect all relevant information you need to make your asset shine if you’re selling or cut through the bull if you’re buying.

![]()

your problem:

Buy-side or sell-side, prepping for data room construction or due diligence review is always a stressful, time-consuming, and usually short-fuse exercise. It is difficult to pull together all the information you need from one location. And if you work for a large company, chances are the assets you are selling are “non-core” and therefore no one seems to have all the current information about the properties, especially the lease data. Buyers would also really like to be prepared before they enter a data room, so they are reviewing and validating claims by the seller, not discovering information for the first time.

![]()

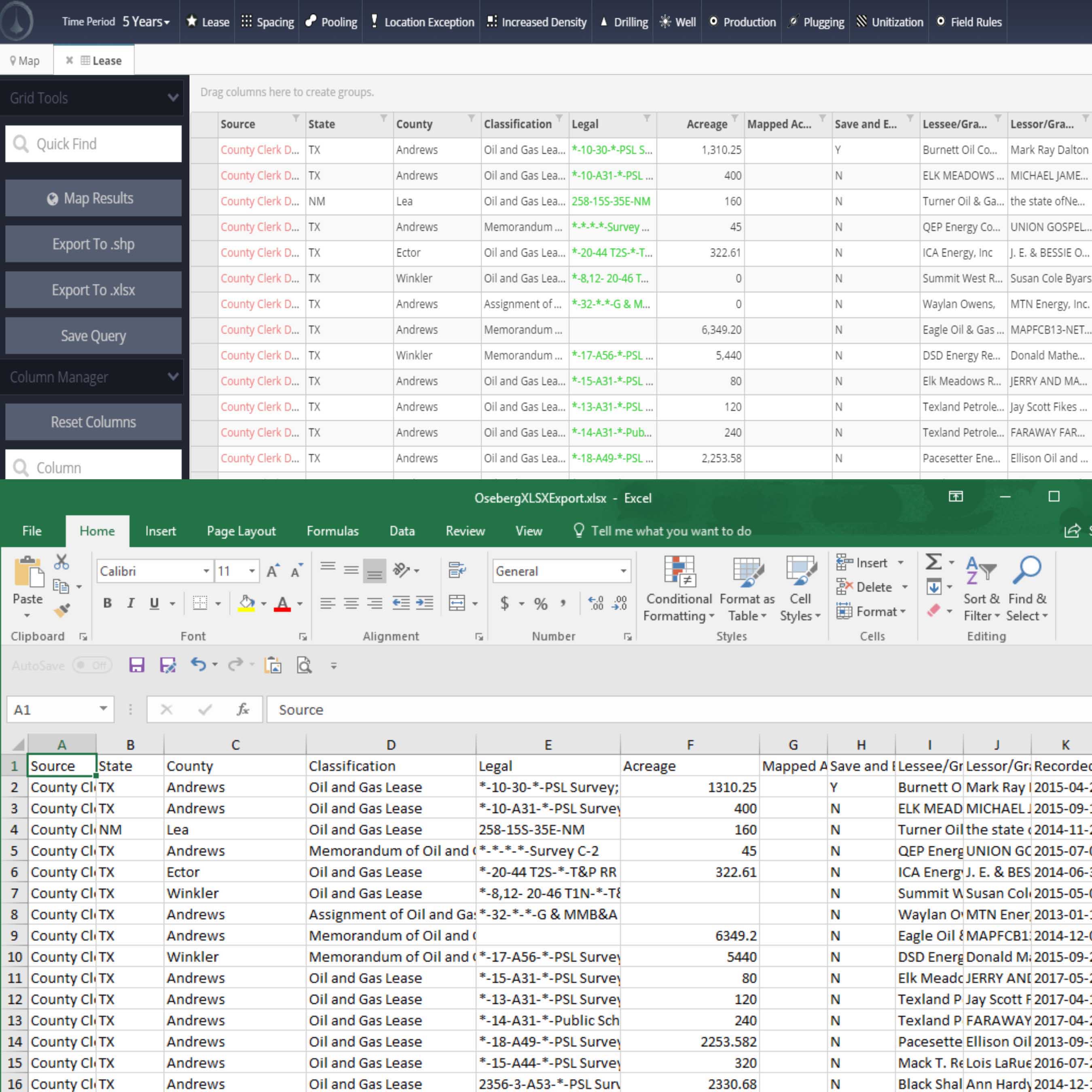

our solution:

oseberg simplifies this process for buyers and sellers by providing all of the available data within a geographical area of interest. Selling companies use oseberg to collect all the relevant information needed to support a prospective buyer’s analysis of the assets (leases, terms of the leases, production data, regulatory obligations, etc.). Data can be easily exported to Excel spreadsheets for easy sharing and uploading to data rooms; maps can be exported as ESRI Shapefiles, compatible with most mapping applications in the industry. Using oseberg applications directly, e.g. Atla, buyers can review substantial datasets before going into the data room, saving you time and reducing the risk of missing something important during due diligence. In other words, there will be no skeletons in the closet!